In this article you will find information about:

1. Inter-company transaction concept-when to be use?

- Company A gets an invoice but full/ part of the cost belongs to Company B , which might be somewhere related to Company A (subsidiary / holding)

- In short, an invoice received by company A must be partly charged to company B; then it is settled via courant accounts maintained by both the companies and such bookings must be posted in both the company’s administrations. Company A will have as receivable from company B and company B will have payable to company A.

2. How this works?

- Company A gets the invoice

- It decides the amount to be borne by company B

- Posts the accounting entry in own books and charges the decided amount on courant account of B and rest amount is booked to its own costs.

- In turn company B also has to post the entry in their books for the share of amount to be paid to company A.

3. How this works in SBQ?

- Based on the setting; SBQ automatically decides whether the particular invoice must be partly / completely charged to one/more administrations.

- And then such single invoice/some lines are added into multiple administrations that are connected for RC bookings.

4. SBQ Setting

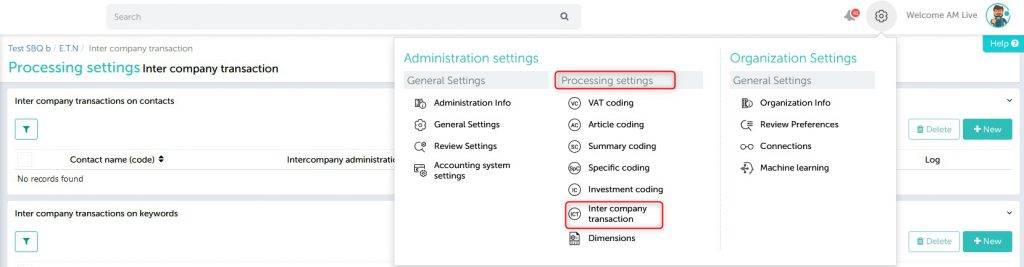

[Select admin à Verwerkingsinstellingen à Intercompany transacties]

- SBQ must know which invoice to be split into multiple admin, for which it has 3 methods

-

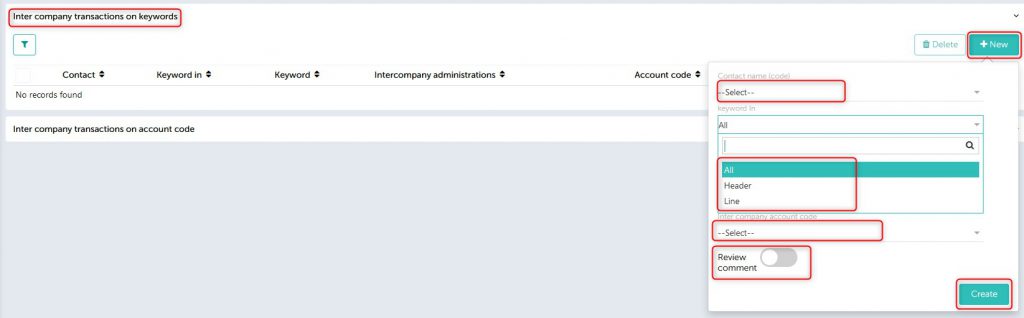

- Keywords

-

- Indicate the KWs present only on 1st half and only on 1st page of the document).

- Has two options: to book full invoice (KW in header) and to book only few lines (KW in lines)

-

-

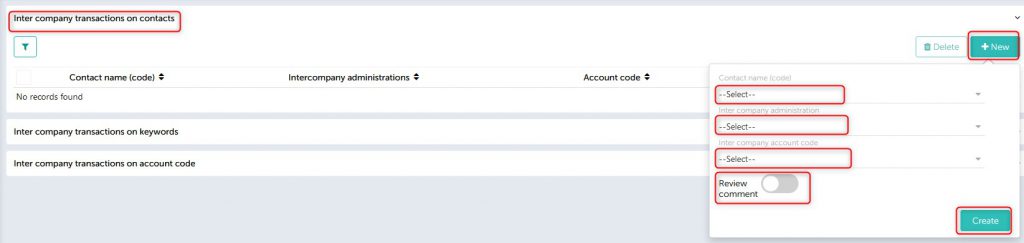

- Relation (in case full relation must be booked in another admin)

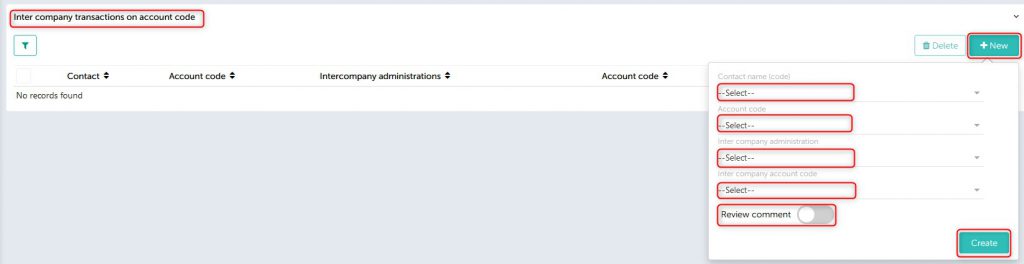

- Account code (in case bookings on certain account codes must be transferred to another admins)

Note: If you switch ON the “Review comment” option then you will get notification for “inter-company settings”.

5. Limitations

- Currently available only for administrations working with Twin field

- Keyword must be present in specified area

- Header KW(Keyword): only on 1st half of 1st page

- Line KW: only within article lines that are read by SBQ

- Relation which needs to be booked in target admin; must be present in both the admins i.e. source admin and target admin.

Note: For ‘Rekening Current’ admin article line vat code will be updated as per selected administration automatically

If ‘Rekening Current administration changed from DDP, then account code and vat code need to update manually -

-