In this article you will find information about:

1.What is “Vat transfer”/ Verlegging’?

2. Setting

2.1. Settings in Smartbooqing

2.2. Settings in Accounting system

2.2.1 AFAS: Settings for vat transfer.

2.2.2.Twinfield:- Settings for vat transfer.

2.2.3. Accountview: – Settings for vat transfer.

2.2.4. Exact online: – Settings for vat transfer.

2.2.5. VISMA: Setting for VAT transfer

1. What is “Vat transfer”/ Verlegging’?

- When you buy goods or services from suppliers in other EU countries, VAT needs to be paid by the buyer.

- Here, the responsibility for the recording of a VAT transaction is moved from the seller to the buyer for that good or services.

i.e. When a German entrepreneur supplies goods to an entrepreneur established in the Netherlands. VAT is reverse-charged to his client, supplier makes an invoice without VAT and mentions ‘VAT reverse-charged’(Verlegged)

2. Setting VAT transfer

2.1. Settings in Smartbooqing

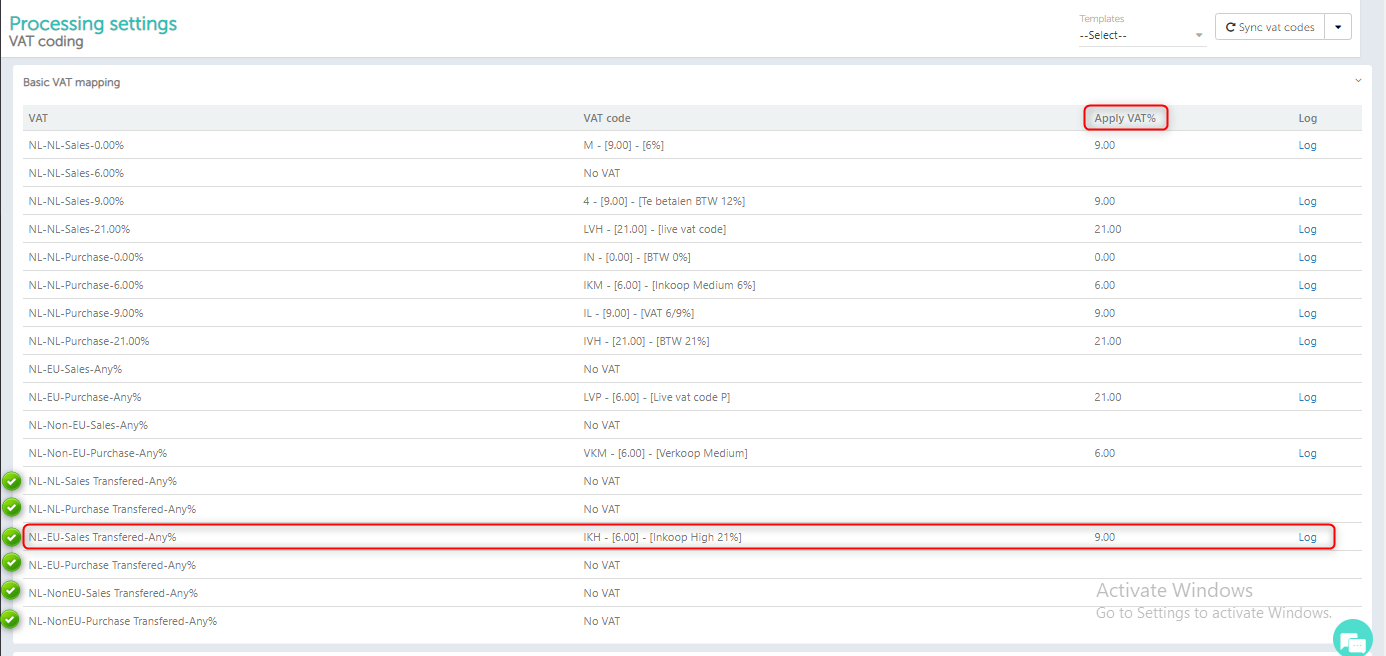

1-.Go to VAT setting, select category ‘transferred’.

2. Set appropriate VAT code.

3. You can also set applicable VAT, if you want to use 0% instead of 21% then set that in last column of applicable VAT.

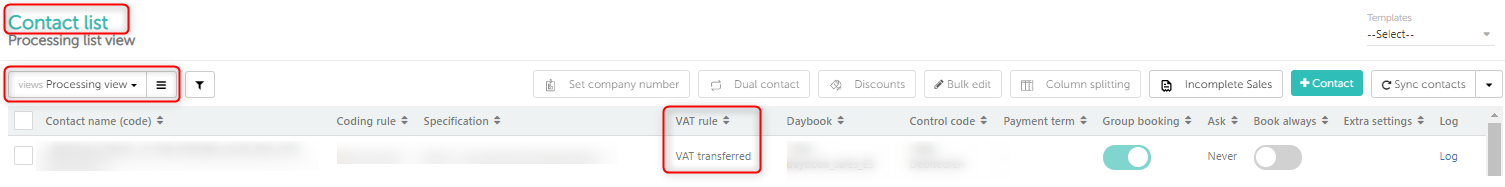

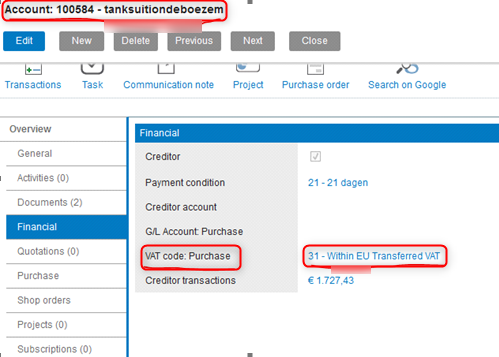

4. Now, go to relation list. Select a relation and set VAT as VAT transferred.

2.2. Settings in Accounting system

| Accounting Systems | Steps |

| AFAS |

|

| Twin field |

|

| AccountView |

|

| Exact online |

|

| eAccounting |

|

| VISMA |

|

More details here:

2.2.1 AFAS: Settings for vat transfer.

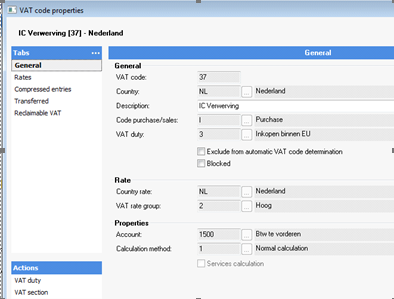

Step1: For Vat code – Vat duty 3.

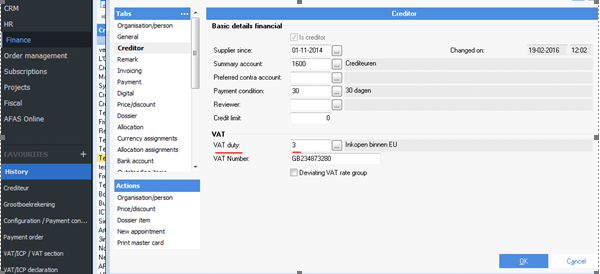

Step2: For creditor – set up BTW plicht (Vat duty) 3 for international creditor.

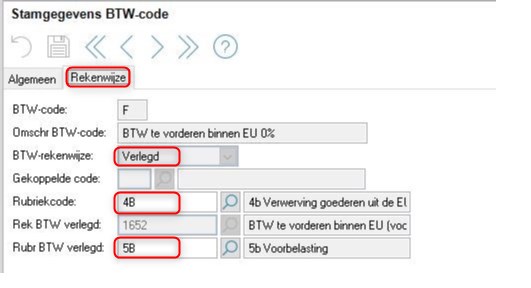

2.2.2.Twinfield:- Settings for vat transfer

2.2.3. Accountview: – Settings for vat transfer

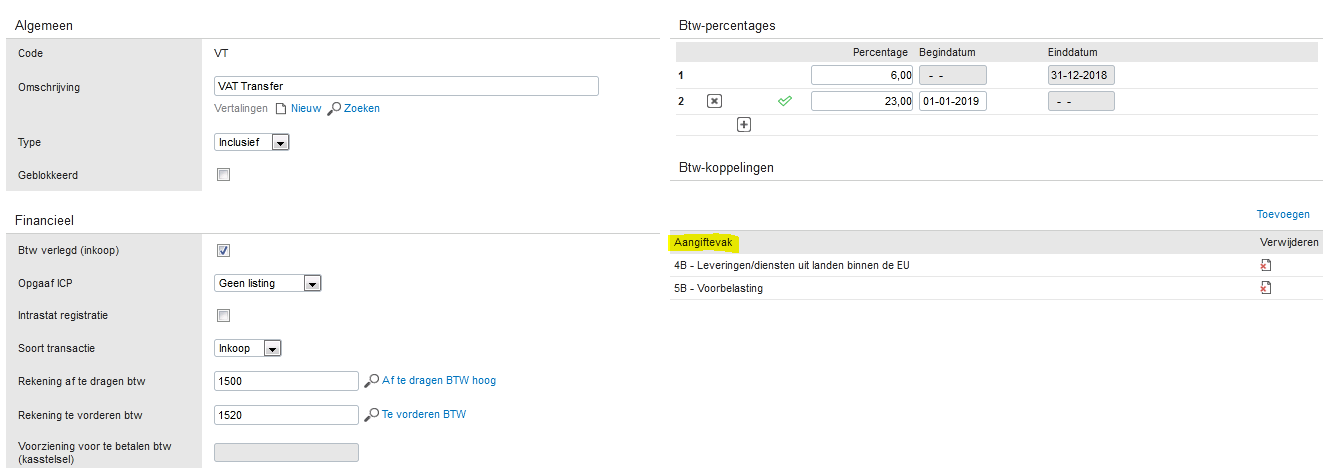

2.2.4. Exact online: – Settings for vat transfer

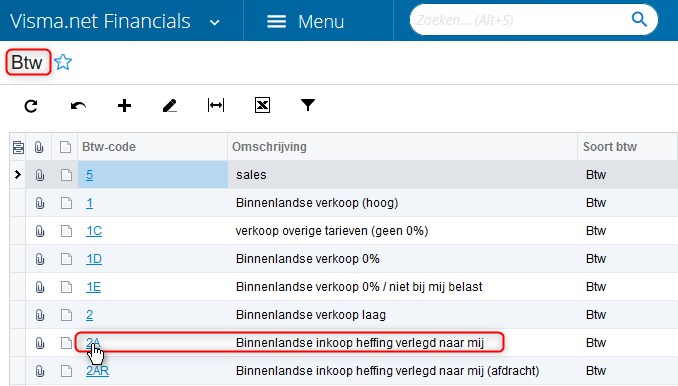

2.2.5.VISMA: – Settings for vat transfer

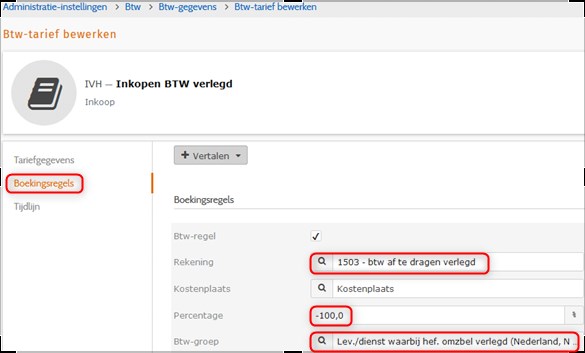

Steps- Got to Financials=> Meer onderdelen=> % Btw=> click on Btw.

Btw-instellingen => Tick the check for “Btw-verlegging”