In this article you will find information about:

- Fixed coding concept- when to use?

- How fixed coding works?

- Settings

- Sample examples of fixed coding invoices

1. Fixed coding-when to use?

When to use it?

- Relation is always booked on the specified account code irrespective of the vat /items on the invoices.

- Invoice may have 2 or more vat on it but still needs same account code for each vat category.

2. How fixed coding works?

- Total amount (incl. VAT) is booked as 1 line along with vat that’s present on the invoice / as per ‘VAT setting’

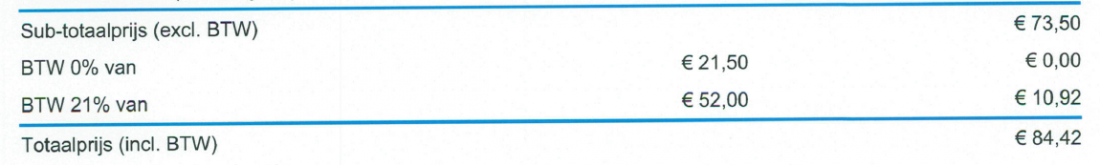

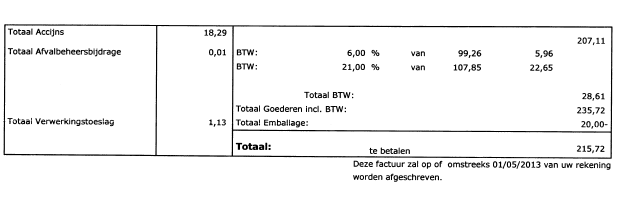

- If invoice has more than 1 ‘VAT %’; then each vat line is booked separately but on the same account code. See invoice example below

- ‘VAT %’ of invoice will be used

- Lines with different ‘VAT %’ will not be booked on one line but separate lines with appropriate ‘VAT%’ and one fixed account code

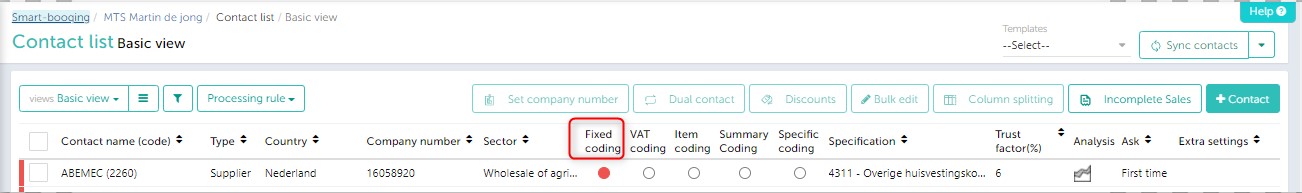

3. Settings

- Select the administration, go to ‘contact list’

- Select / search the contact

- Double click to go into the edit mode.

- Select the desired rule from the drop down in column ‘coding rule’ and provide ‘specification’.

4. Some examples of fixed coding invoices

Example 1:

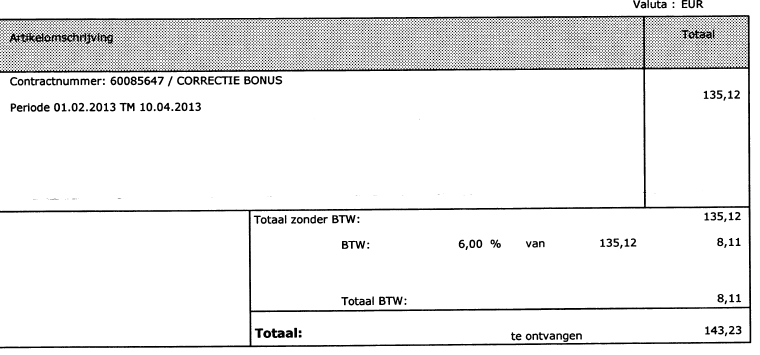

Example 2:

Example 3:

Example 4: