In this article you will find information about:

- When can this feature be used?

- How does it work?

- Difference in amount

- Fixed Amount

- Percentage

- Restrictions

1. When can this feature be used?

- Background:

- SBQ reads basic amounts from the invoice’s totals i.e. amount before vat, vat amount and amount after vat.

- Sometimes there are additional costs or discounts that need to be booked specially.

- They go unnoticed if Smartbooqing doesn’t read them. Therefore, this feature is offered to define such additional charges or discounts that can be applied to invoices from certain business partners.

- When certain deductions or additions need to be made for invoices from certain business partners, this function is useful.

- Following can be set up using this function

- Discounts (as a lump sum or as %)

- Payment discounts (as a fixed amount or as %)

- Any fixed addition / deduction

- Differences in amounts (payment differences)

- Total amount of the items on the invoice does not correspond to the VAT including amount

- Calculation error in the invoice e.g. addition of amount excluding VAT and VAT amount is not equal to the amount including VAT

- At the end of the normal posting lines of the invoice; The system will add an additional booking line with this setting.

- Note: This feature is available for all business partners and at all processing settings

2. How does it work?

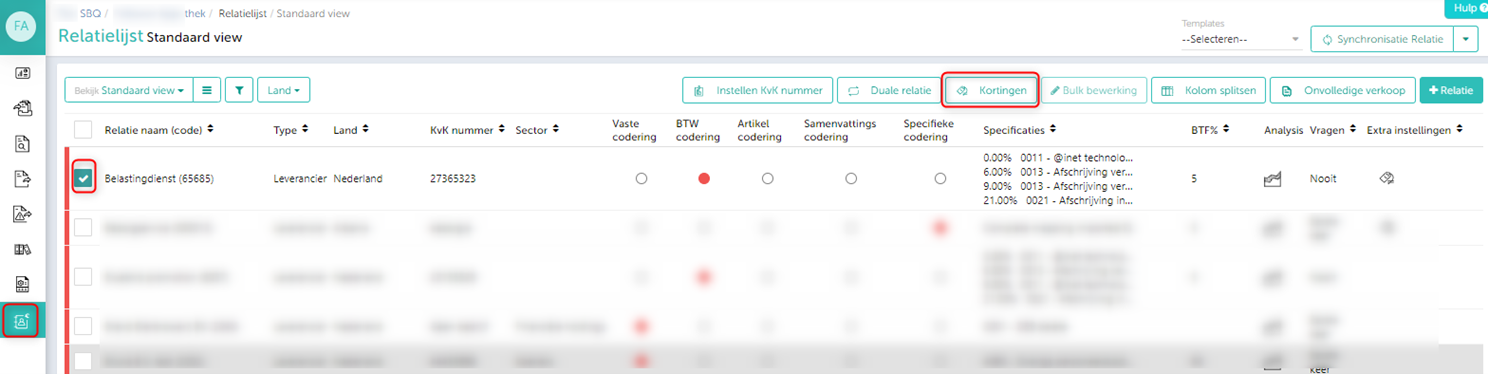

- Go to Contact List select the contact and click on ‘Discounts’. (image 1 below)

- The symbol is shown for activated discount setting in column ‘Settings applied’

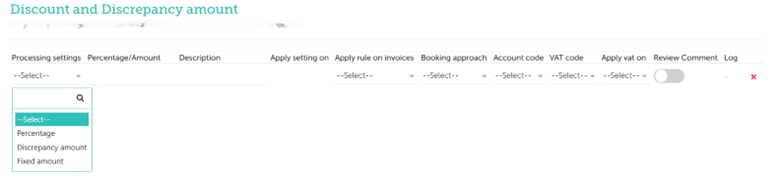

- Set up the following

3. Difference in amount

- See paragraph above.

- Set up a G/L account to which the payment difference can be posted.

4. Fixed amount

-

- Choose the amount (not %)

- Apply rule to invoices: Does it apply to all invoices/ only to invoices with positive amounts/ only invoices with negative amounts

- Booking approach:

- Reduce: The selected amount will be deducted from the total invoice amount (Incl. VAT)

- Increase: The selected amount will be added to the total invoice amount (Incl. VAT)

- Select the VAT code account and Apply VAT on Amount (Incl.VAT or Excl.VAT)

- On Review note: Choose this if these rules are to be displayed on the Review page

5. Percentage:

- Everything is the same as above except for an additional condition as described below:

- Choose the % (no amount)

- Apply Setting To – Based on the selection, the system will apply the selected amount / % to the “amount including tax” or the “amount excluding tax”.

- For example, 5% discount is applied:

| Apply on ‘incl. vat amount’

Excl. barrel 100 Keg 21 Incl. barrel 121 Discount 6.05 (5% on 121) |

Apply on ‘excl. barrel amount’

Excl. barrel 100 Keg 21 Incl. barrel 121 Discount 5.00 (5% on 100) |

Figure 1 (contact list where the institution is present)

Figure 2 (parameters that can be set)

6. Restrictions

- Current discounts mentioned on the invoice are not included in the system. Only the calculated value in percentage as specified in the settings is applied. Only % can be entered in the ‘percentage’ section. No amounts.

- Only amounts can be entered under ‘fixed amount’.

- VAT is not applied to these three additional rules.

- To find the ‘difference in amount’, the system will check the total amount including VAT of the item lines. Not the amount excluding VAT, which can sometimes be the case.

- Discount settings will have higher priority than Rounding setting.